Rand Slips 1% on Friday, Concluding a Volatile Month Ahead of Crucial Budget and Trade Figures.

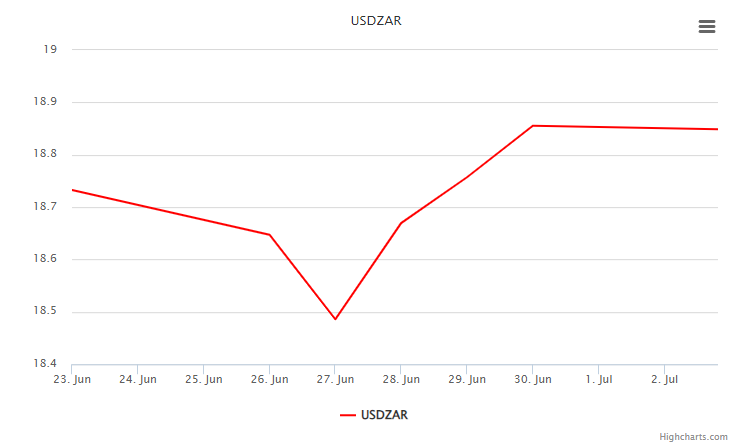

The South African Rand traded at R19.01 against the US Dollar at 12:45, reflecting a slight decline. Meanwhile, the Dollar demonstrated strength by trading around 0.1% higher against a basket of global currencies. Kieran Siney from ETM Analytics noted that the Rand faced selling pressure as external developments influenced market sentiment, despite starting the week positively. Nevertheless, the Rand has shown remarkable resilience, appreciating by over 4% against the Dollar since the beginning of June, positioning it as the second-best-performing emerging market currency this month.

Andre Botha from TreasuryONE acknowledged the Rand's commendable performance in the past two weeks, suggesting that a period of consolidation was necessary. In terms of economic indicators, recent data from the central bank revealed that South African private sector credit experienced a year-on-year growth of 6.85% in May, with money supply increasing by 10.30% during the same period.

Looking ahead, May's monthly budget and trade balances are set to be released around 1200 GMT. According to analysts polled by Reuters, it is anticipated that May will yield a trade surplus of R6 billion, surpassing April's surplus of R3.54 billion. On the Johannesburg Stock Exchange, both the Top 40 blue-chip and broader all-share indices showed positive momentum, trading over 1% higher. Conversely, the benchmark 2030 government bond displayed weakness, with its yield rising by 7.5 basis points to 10.570%.